Long-Term Wide Range Creation With Realty: A Comprehensive Guide

Property has actually long been considered as a effective device for structure and sustaining wealth with time. Unlike various other financial investments, real estate offers security, easy earnings, and capacity for significant appreciation. This write-up explores the methods, benefits, and factors to consider for accomplishing long-term wide range development via realty investments.

Why Property is Ideal for Long-Term Wide Range Development

1. Steady Revenue Generation

Having rental buildings can supply regular passive revenue. Well-located residential or commercial properties bring in long-term occupants, ensuring a trustworthy cash flow to reinvest or save.

2. Resources Appreciation

Realty has a tendency to raise in value in time, particularly in expanding markets. Strategic financial investments in high-demand areas can result in considerable recognition, enhancing total wide range.

3. Utilize Opportunities

Real estate allows you to use borrowed funds to purchase assets, increasing your potential returns. Through leverage, you can get beneficial properties with minimal ahead of time resources.

4. Tax Advantages

Investors gain from reductions on mortgage interest, residential or commercial property depreciation, and various other costs, reducing gross income and improving overall returns.

5. Profile Diversification

Including realty to your portfolio lessens risk by expanding possessions. Property typically performs in different ways from stocks and bonds, giving stability throughout market variations.

Secret Approaches for Long-Term Wealth Development in Property

1. Buy-and-Hold Method

This method entails acquiring homes and keeping them for expanded periods to take advantage of consistent capital and residential or commercial property recognition. It's a low-risk approach perfect for patient financiers.

2. Buy Arising Markets

Recognizing promising locations with development possibility can produce greater returns. Seek areas with increasing work markets, framework growth, and population growth.

3. Concentrate On Rental Properties

Investing in multi-family homes, single-family services, or business rooms can produce constant income while constructing equity with time.

4. Reinvest Revenues

Utilizing rental income and earnings to acquire additional residential or commercial properties creates a snowball result, speeding up wealth development.

5. Go with REITs

For investors who like a hands-off strategy, Real Estate Investment Trusts (REITs) provide exposure to realty markets without the demand for straight property ownership.

Steps to Start in Real Estate Investing

1. Define Your Goals

Identify whether you're searching for stable income, long-term appreciation, or a combination of both. Your objectives will certainly form your investment technique.

2. Conduct Market Research

Understand local market fads, building worths, and rental demand to make informed choices. Expertise of the market reduces threats and makes best use of returns.

3. Safe and secure Financing

Explore funding options such as typical home loans, private lending institutions, or partnerships. Pre-approval guarantees you're ready to act when possibilities develop.

4. Build a Team

Collaborate with experts like property agents, property managers, and economic advisors to enhance the investment process.

5. Screen and Maintain Characteristics

Routine property maintenance makes sure lessee complete satisfaction and protects building Green Springs Capital Group value, which is essential for long-lasting success.

Typical Obstacles in Property Spending

1. Market Volatility

Property markets can fluctuate due to economic problems. Diversity and thorough market evaluation can mitigate threats.

2. High Upfront Prices

While property supplies substantial returns, the preliminary financial investment can be considerable. Proper financial preparation and utilize are crucial to overcoming this challenge.

3. Time Commitment

Taking care of properties calls for effort and time. Outsourcing jobs to residential property managers can ease this worry.

Situation Studies: Effective Wealth Production in Realty

1. Multi-Family Properties

An capitalist in a growing suburb purchased a multi-family building, leveraging rental earnings to fund additional procurements. Over 15 years, the portfolio's value tripled.

2. Fix-and-Hold Approach

By buying underestimated homes, renovating them, and holding onto them, an additional investor accomplished a 10% yearly admiration rate while taking pleasure in increased rental income.

Tips for Optimizing Long-Term Returns

Purchase Quality Locations: Prime areas produce higher rental earnings and much better admiration with time.

Keep Educated: Frequently update your understanding of market patterns and investment methods.

Take Advantage Of Innovation: Use home administration software application to improve operations and improve performance.

Connect with Professionals: Join local property financial investment teams to learn from experienced capitalists and discover new possibilities.

Realty stays one of one of the most effective methods for long-lasting wealth production. By focusing on strategic financial investments, steady revenue generation, and market gratitude, capitalists can develop a durable financial future. Whether you're a skilled investor or a novice, real estate uses a wealth of chances to attain monetary freedom and lasting prosperity.

Beginning exploring today and unlock the capacity of property as a cornerstone for your long-term riches approach.

Jake Lloyd Then & Now!

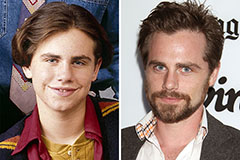

Jake Lloyd Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!